Dear WeWork Shareholders,

I’m incredibly pleased that in 2022 we were able to continue to execute on our plan by improving our operating metrics, strengthening our balance sheet and bolstering liquidity.

Revenue, memberships, occupancy increased in each quarter of the year, while we continued to significantly reduce costs. We were able to improve revenue to $3.25 billion, a 26% increase year over year. This growth in revenue would not have been possible without the trust our members place in our product and platform, and the dedication of my colleagues and our partners around the world.

This is WeWork’s moment.

It was almost exactly three years ago to the day that I participated in my first TV interview as CEO of WeWork to talk not only about the strategic plan forward for the Company’s transformation, but also why I believed flexibility would drive the future of the office and the way we work. Since that interview, we built on our product suite to adapt to the seismic shift in the industry in order to further capitalize on all areas of demand with our physical space product of real estate, and our digital products of All Access and WeWork Workplace.

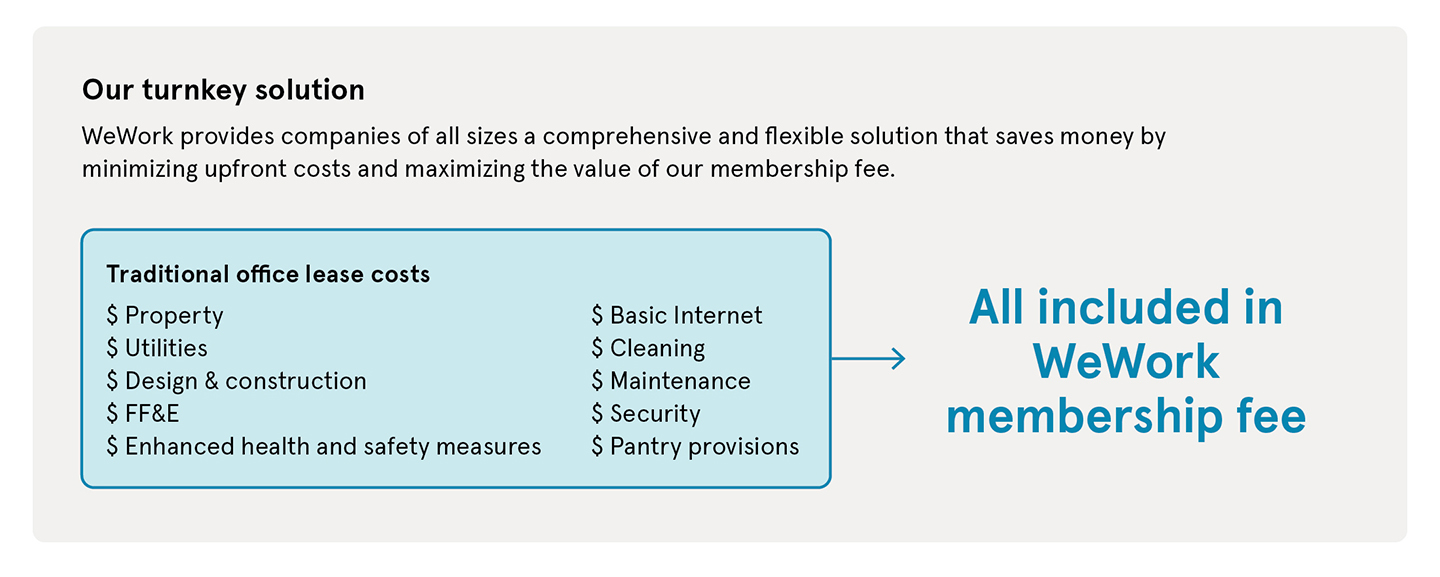

WeWork provides a complete solution, flexibility of space and time, and an environment that fosters collaboration. We don’t own the assets, hence are not bootstrapped by mortgages on any assets. Our proposition is turnkey, hence not subject to tenant allowances which add a burden at a time of limited liquidity.

In a time of uncertainty for space occupiers, WeWork can provide certainty.

The New Office Demand

In a matter of months in 2020, the centuries old standard way of working was flipped on its head. Compounding this, a variety of macroeconomic factors have forced companies to lean into truly rethinking their office/workplace strategy—with an eye towards optimizing costs and relieving pressure from their balance sheet.

In short order a new world of work has emerged and is defined by three key components.

- Companies demand flexibility across space, time and cost. From small businesses to large enterprises, companies want the ability to grow or shrink their space as needed with the option of short or long term leases that can optimize their real estate costs.

- Companies want certainty and convenience in uncertain times. They need turnkey space that can be delivered when and where they need it to support evolving business needs. Pre-pandemic, HR departments could plan their headcount for the full 10 years of a lease, and now long-term commitments are met with scrutiny to ensure they fit business needs of today.

- Companies want space that can bring people together. Regardless of various workplace strategies, the value of the office remains evident—however the design and environment must serve a purpose.

As a result, the demand that was traditionally driving the commercial office industry has fundamentally changed. We believe that the traditional market must be agile and flexible to adapt to this new demand.

Disruption of The Traditional Office Industry

The traditional commercial office industry was built on larger footprints, long-term leases, cash available for capex and long-lead delivery. Now with these elements being far less attractive to occupiers, this model is in question. Constraints on liquidity and diminution of value of real estate, which put pressure on refinancing of mortgages, restrict landlords’ abilities to repurpose assets at speed, provide the rich tenant improvement allowances to build out spaces that can attract employees, and deliver free rent periods and other concessions that will be demanded by long-term tenants moving forward.

On top of this, the fundamentals that contributed to profit opportunities for owners and lenders are diminishing as well. With net effective rents falling, higher interest rates and less access to capital to improve office buildings, the tried-and-true strategy of buying buildings, repositioning them, leasing them up, and selling for a profit at compressed cap rates, has become increasingly difficult.

Why WeWork Is The Solution

Just as we saw the brick-and-mortar retail industry transform with e-commerce, we believe a seismic behavioral shift is transforming the traditional commercial office landscape—putting WeWork front and center as the flexible solution.

We have built a category-leading brand, and we stand alone in the commercial real estate industry as a household name recognized around the world by individuals, entrepreneurs, small businesses, and Fortune 500’s alike.

WeWork does not work on the traditional model of large concessions to build space with long payback periods. Instead, our spaces have been largely built out with Enterprise-grade designs and materials that are currently used by our largest Fortune 500 members. With no need to invest upfront (by WeWork or the member), there is no need to tie our members up in long term leases. The cost of the build out has been completed before our discussion started and has no impact on our deal. In a “start and stop” age of real estate decision making, a company’s ability to sign a WeWork membership agreement in a matter of days contrasts starkly with a tenant’s ability to sign a new traditional lease.

We believe that WeWork is the only provider that can deliver on what companies need today with a holistic flexible and digital solution through our three core products. As evidenced by our performance over 2022, we continue to capture the demand of this new office era.

2022 Business Performance

Balance sheet

As we announced in March 2023, we have proposed a transaction with both our equity and bond holders to fully capitalize the Company, significantly reduce leverage and extend maturities through 2027. The proposed transaction could achieve these three primary objectives and result in a more sustainable capital structure for the benefit of all stakeholders. Subject to bondholder and shareholder approval, the transaction could result in total funding and capital commitments of over $1 billion. Most importantly, upon close, we believe that WeWork will have a balance sheet that supports its business plan for the long term.

Revenue

Looking at our top-line, revenue for the full-year 2022 was $3.25 billion, an increase of 26% from 2021, and meeting the goal we set out at the beginning of the year. Revenue increased in each quarter, resulting in 18% growth year-over-year in Q4.

Our revenue growth is an outstanding achievement in the face of the macroeconomic challenges throughout the year such as FX fluctuations, prolonged COVID outbreaks which delayed return-to-office, significant workforce reductions across US companies, and the global energy crisis.

Expenses

Improvements in Adjusted EBITDA, stemmed from careful consideration of our two largest expenses, Location Operating Expense and SG&A. As occupancy continues to rise, the incremental revenue generated outpaces the incremental operating expenses, thus increasing Building Margin and Adjusted EBITDA, illustrating the operating leverage of the WeWork platform.

Space-as-a-Service

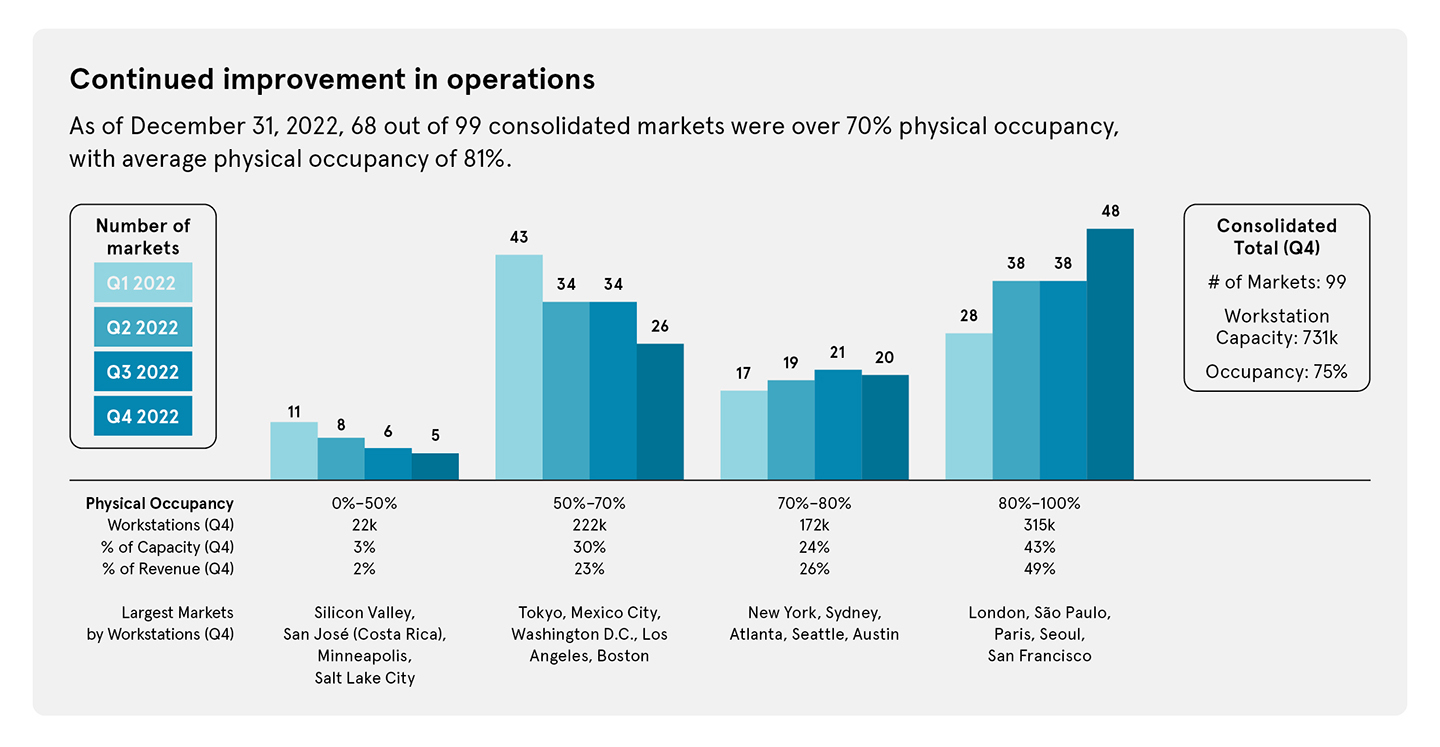

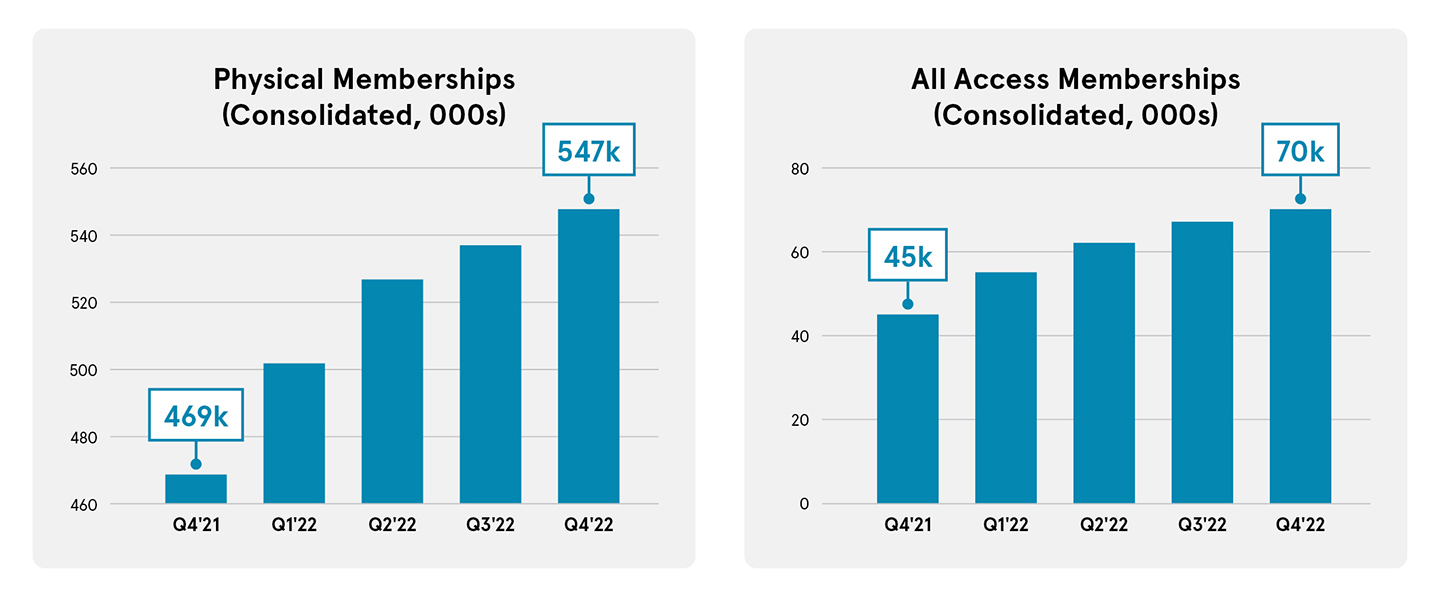

Revenue growth in the year was primarily driven by increased occupancy and a focus on pricing. Occupancy reached 75% with 547,000 consolidated physical memberships in Q4, an increase of 17% year-over-year. On a systemwide-basis, we ended the year with 682,000 physical memberships, the highest in WeWork’s history. While our primary focus in 2021 was occupancy, in 2022 we saw the opportunity to increase pricing as our offices filled-up over the year.

By focusing on local demand, we made strides in 2022 increasing the occupancy of the majority of our markets, bringing an additional 33 markets above the 70% occupancy mark relative to the end of 2021. At the end of the year, 68 of 99 total markets were over 70% including New York, London, San Francisco, São Paulo, and Paris, making up 75% of revenue. The trend is clear in the chart set out below: our markets continue to increase in occupancy and margin.

Digital Products

The complementary products to our core business were key drivers of our growth. Our Access business, which includes our subscription-based All Access memberships and pay-as-you-go On Demand products, grew to 70,000 members in Q4, a 56% increase year-over-year. The Access products, which were launched just two years ago, generated $200 million of annualized revenue as of Q4. We anticipate continued growth of our All Access product in 2023 as we launch tiered membership plans such as All Access Basic and All Access Plus, offering the pinnacle of flexibility as a standalone product or as a complement to dedicated space.

In April, 2022, we announced our joint partnership with Yardi, the leading residential lease management software provider to develop our WeWork Workplace office management software. The partnership combined Yardi’s technical software expertise with WeWork’s vast network of companies in our customer base. The management software solution Yardi and WeWork developed is a booking service for workstations in WeWork locations and other office space, enabling employees to share desks, and coordinate in-person work with their colleagues. We’ve been actively marketing our WeWork Workplace product since its public debut in the Fall of 2022 and had sold over 42,000 licenses to over 220 companies by year-end.

Increasing Market Share

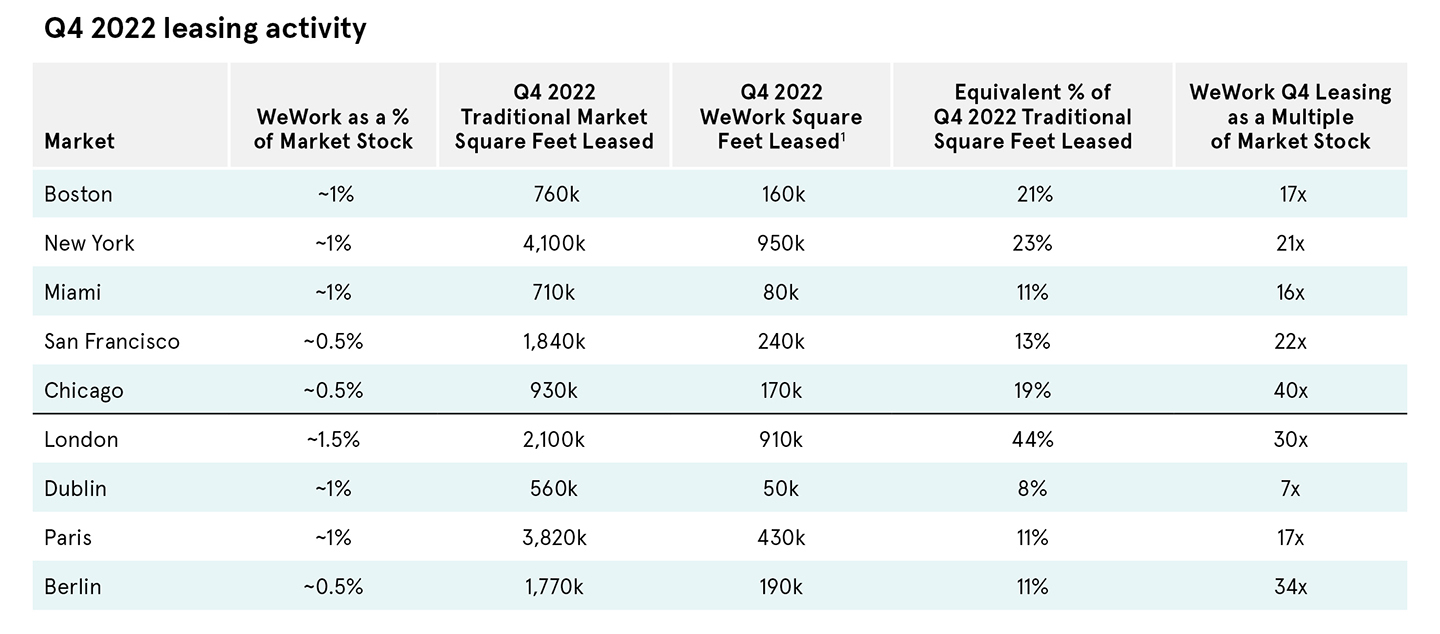

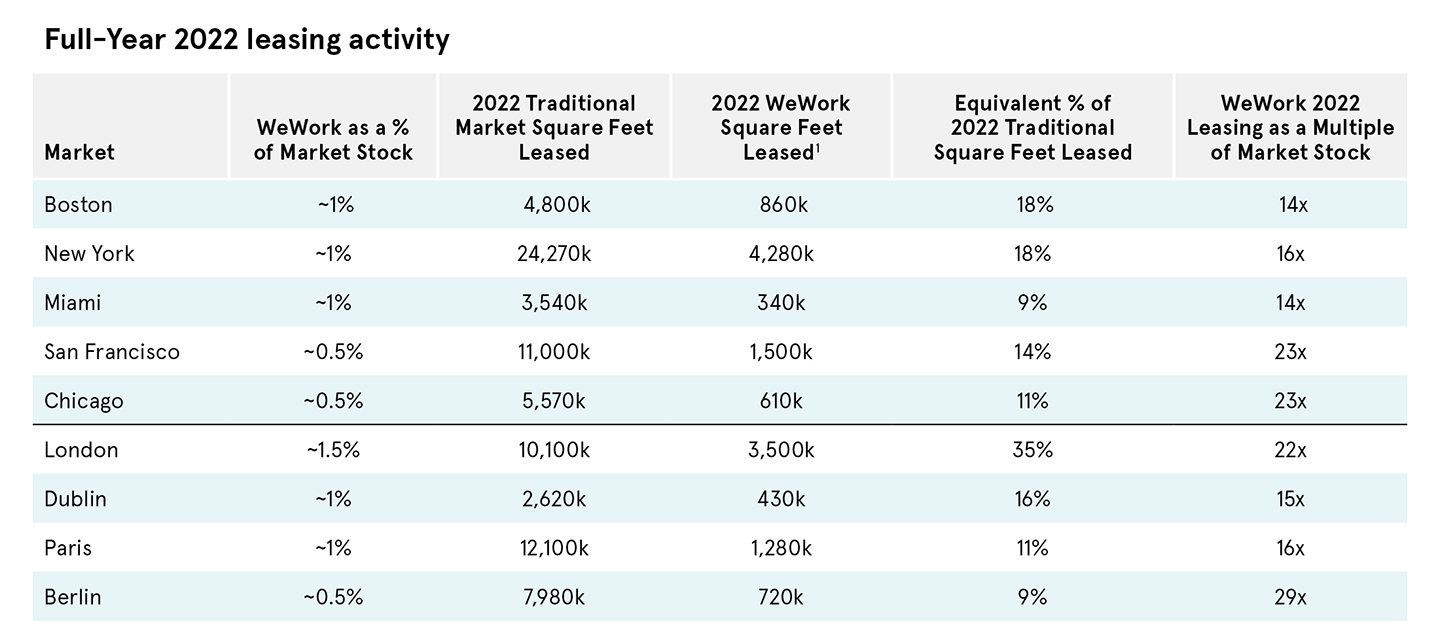

At the market-level, WeWork’s 2022 gross sales in Manhattan were equivalent to 18% of the traditional office market leasing on a square-foot basis, while WeWork’s portfolio accounts for approximately 1% of total office stock. Similarly, in London, WeWork’s 2022 gross sales in London were equivalent to 35% of traditional leasing activity while accounting for roughly 1.5% of total office stock. As you’ll see in the tables set out below, the growth pace of our market share accelerated during the fourth quarter in many of our largest markets. Our gross sales in the year totaled just under 40 million square feet, or the equivalent of the Empire State building, One Vanderbilt, One Penn Plaza, and One World Trade Center combined, four times over. This volume of leasing is only possible with a specialized sales team, e-Commerce sales channel, and account managers that stay close to our customers after they’ve taken occupancy.

WeWork represents an outsized portion of demand

With WeWork continuing to capture an outsized portion of commercial office leasing activity, we believe flexible space is on a trajectory to be a separate channel of distribution for office space, similar to the transformation of retail and e-Commerce. In 2000, e-Commerce represented roughly 1% of retail sales but grew to 21% of the market in the US by 2020. Retailers who moved quickly to integrate the new technology into their business to become omni-channel ultimately became the market leaders, while those who resisted struggled to keep their businesses afloat.

Flexible office space today represents just 2% of the overall commercial real estate market. CBRE and JLL have projected it to become between 13% and 30% of total office supply by 2030 in the US alone, which represents a revenue opportunity of between $45 and $105 billion.

Looking Ahead

Against the backdrop of a growing flex industry, our focus on membership and pricing growth, balance sheet and portfolio optimization, and sustained profitability are the building blocks on which we will grow our platform and achieve our goals.

WeWork’s growing demand and market share of space is a testament to the value of our product and the variability of our offerings. Our digital products, Access and Workplace, solve for an evolving world with immediate and frictionless access to work space at a global scale.

Today, we believe we have created a category of our own. We are committed to transforming our business, however we are equally focused on listening closely to our members in order to continuously innovate on our product line and process. I remain incredibly confident about the short term and long term success of the business.

We are grateful for your continued support.

Sincerely,

Sandeep Mathrani Chief Executive Officer and Chairman

___

Disclaimers

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction in connection with the transactions or the related stockholder approvals or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In particular, this communication is not an offer of securities for sale into the United States. No offer of securities shall be made in the United States absent registration under the Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the WeWork’s previously announced transactions intended to strengthen its capital structure by restructuring its outstanding debt and raising additional capital and the related stockholder approvals (collectively, the “transactions”), WeWork will file with the Securities and Exchange Commission (the “SEC”) a proxy statement (as amended or supplemented from time to time, the “proxy statement”). BEFORE MAKING ANY VOTING DECISION, WEWORK’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTIONS AND THE RELATED STOCKHOLDER APPROVALS OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT (IF ANY) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND THE RELATED STOCKHOLDER APPROVALS AND THE PARTIES TO THE TRANSACTIONS. WeWork’s stockholders and investors will be able to obtain, without charge, a copy of the proxy statement and other relevant documents filed with the SEC (when available) from the SEC’s website at www.sec.gov. WeWork stockholders and investors will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a written request to WeWork Inc., 75 Rockefeller Plaza, New York, NY 10019, Attention: Investor Relations or from WeWork’s website, investors.wework.com.

PARTICIPANTS IN THE SOLICITATION

WeWork and certain of its directors and executive officers and employees may be considered participants in the solicitation of proxies from the stockholders of WeWork in respect of the stockholder approvals relating to the transactions. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the stockholders of WeWork in respect of such stockholder approvals, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information regarding WeWork’s directors and executive officers is contained in WeWork’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and its Proxy Statement on Schedule 14A, dated April 7, 2022, which are filed with the SEC, and certain of WeWork’s Current Reports on Form 8-K, filed with the SEC on May 26, 2022, June 27, 2022, August 11, 2022, December 2, 2022, February 7, 2023 and February 21, 2023.

FORWARD-LOOKING STATEMENTS

Certain statements made herein may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including any statements regarding the transactions and the related stockholder approvals. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “pipeline,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Although WeWork believes the expectations reflected in any forward-looking statement are based on reasonable assumptions, it can give no assurance that its expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to, the terms of the transactions, which are highly uncertain; WeWork’s ability to complete the transactions on the terms contemplated or at all; WeWork’s ability to obtain the required stockholder approvals; WeWork’s ability to otherwise refinance, extend, restructure or repay outstanding debt; its outstanding indebtedness; its current and projected liquidity needs to operate its business and execute its strategy, and related use of cash; its ability to raise capital through equity issuances, asset sales or the incurrence of debt; WeWork’s expectations regarding its ability to continue as a going concern; retail and credit market conditions; higher cost of capital and borrowing costs; impairments; changes in general economic conditions, including as a result of the COVID-19 pandemic, the conflict in Ukraine and disruptions in the banking sector, and the impact of such conditions on WeWork and its customers; WeWork’s expectations regarding its exits of underperforming locations, including the timing of any such exits and ability to retain its members; delays in customers and prospective customers returning to the office and taking occupancy, or changes in the preferences of customers and prospective customers with respect to remote or hybrid working, as a result of the COVID-19 pandemic leading to a parallel delay, or potentially permanent change, in receiving the corresponding revenue; the impact of foreign exchange rates on WeWork’s financial performance; and WeWork’s inability to implement its business plan or meet or exceed its financial projections. Forward-looking statements speak only as of the date they are made. WeWork discusses these and other risks and uncertainties in its annual and quarterly periodic reports and other documents filed with the SEC. WeWork undertakes no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise, except as required by law.

USE OF NON-GAAP FINANCIAL INFORMATION

This communication includes certain financial measures not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including Adjusted EBITDA and Building Margin. These financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to net loss or other measures of profitability, liquidity or performance under GAAP. You should be aware that our presentation of these measures may not be comparable to similarly titled measures used by other companies, which may be defined and calculated differently. WeWork believes that these non-GAAP measures of financial results provide useful supplemental information and management uses forward looking non-GAAP measures to evaluate WeWork’s projected financials and operating performance.