A startup is more than an early stage company. It’s a small operation reaching for something big; an innovation ready to explode. If this sounds like your business, learn some of the latest startup lingo to help you in the early funding stages.

1. Acqui-hired

When a small, failing company is purchased solely for its staff. It’s kind of like acquiring the intellectual capital of a ready-made, talented crew. According to a CBInsights acqui-hire report, between 2012 and 2013, 60% of all acqui-hired tech companies were internet companies and 38% were mobile.

2. Angel investor

An individual who invests his or her own money at an early stage in exchange for a share of the company. An angel can be a high net worth entrepreneur or friend or family member willing to invest in a great idea. Angel investors tend to invest fewer dollars than venture capitalists, although some form angel groups to invest in bigger business opportunities.

3. Burn rate

The amount of cash you are spending each month in relation to your capital. Divide your capital amount by your burn rate to determine the lifespan of your company (at least until the next funding round).

4. Convertible note

A note is worth a percentage of equity ownership in a company. Some business owners use convertible notes if they want to attract angel investors without having to put a valuation on the company. The note turns into equity as soon as another investor comes in.

5. Disrupt/disruptive

“The selling of a cheaper, poorer-quality product that initially reaches less profitable customers but eventually takes over and devours an entire industry,” from 1997’s The Innovator’s Dilemma, by Clayton M. Christensen. Disruptive has since become a way to describe a product or technology that will change its marketplace.

6. Exit strategy

The way you envision getting money out of your company. It’s another way of thinking about your future plans for the company. Either you want to sell it, get acquired (or acqui-hire), merge with another company, go public, or liquidate the business completely. Having this answer now will keep you a step ahead.

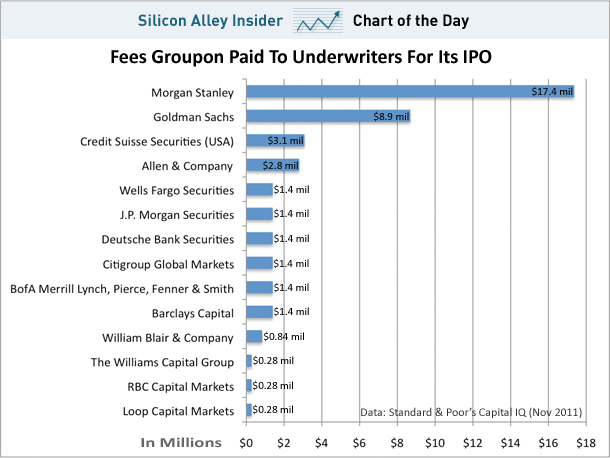

7. Going public

A company’s IPO, or initial public offering. Think of it as just another way to raise funding. You are offering shares of your company for purchase to the public. It could make you rich but it could also cost a lot. IPO deals are structured by investment banks, and your company is valued by analysts. There are pros and cons to going public and only a small percentage of millions of U.S. companies actually do it. Investment in IPOs can be risky but can pay off big for some investors.

8. Incubator

Startup incubators are groups that support chosen entrepreneurs and/or their businesses with mentorship and funding. In exchange, the incubator takes an equity stake in the company. Increasingly popular and competitive in the tech world, incubators have been touted as the new business schools.

9. Nondisclosure agreement (NDA)

A legal document that protects a startup’s secrets by holding employees responsible to pay damages for leaking them. NDAs can be used to protect things like proprietary code, formulas, or customer information. You can have a “one party” NDA where one side is receiving confidential information from the other, or a mutual NDA for both parties.

10. Pivot

A course correction for startups based on findings in user testing and analysis.

11. Seed round or Seed stage

The first round of venture capital funding for a business venture. This is for the development stage, just past the angel round, and can be up to $1 million of capital. Subsequent rounds are referred to in terms of Series (Series A, B, C, D, E) or stages (startup stage, formative stage, mezzanine stage).

12. Valuation (pre-money valuation, post-money valuation)

How much your company is worth. But that’s putting it simply. There are several different formulas for determining the valuation of your company when you plan to sell shares. Pre-money valuation is how much a startup company is worth before funding; post-money valuation is the value for the company plus the funding. Again, sounds simple, but how you value your company compared to the size of the investment can quickly dilute your shares. Valuation happens at every round or stage of funding.

13. Venture capitalist (VC)

A professional individual who invests money in businesses in exchange for an equity share of the company. Because VCs and venture capital firms invest institutional dollars (for investors, funds, and pension plans, etc.), they usually focus on proven or later-stage startups and invest greater amounts of money (typically at least $2 million per round).

14. Vesting

The schedule under which founders and employees must remain in the company before receiving their full share of the equity. For example, if you have a five-year vesting schedule you may get access to 0% in year one, 25% in year two, 50% in year three, 75% in year four, and 100% in year five. A vesting schedule helps to instill staff loyalty and keep the company together for a certain period of time. Cliff vesting is when someone becomes fully vested on a specified date.

Make the leap from wannapreneur to entrepreneur. Start with General Assembly’s course in Business Fundamentals & Tactics and make your business idea a reality.

This post originally appeared on General Assembly’s blog.

General Assembly is pleased to host an intimate evening of talks, panels, and personal conversations about fundraising strategies with New York City investors and entrepreneurs on October 23.

The Assembled Capital: A Founder’s Guide to Fundraising event will have speakers, including VC Nihal Mehta, Plated co-founder Josh Hix, and Barkbox founder and CEO Matt Meeker, who will share personal stories about successful (and not-so-successful) capital raises, industry best practices, common misconceptions, evolving trends, and other essential learnings from the field. Tickets are limited, so reserve your spot today.