The travel business has gotten extremely competitive, bordering on cutthroat, with companies battling to reach potential customers at every stage of planning their trip—from searching about possible destinations, to sifting through their options for hotels and flights, and then finally to hitting the button to make a purchase.

Despite its maturity as a digital business, travel remains an industry where there’s still a great deal of opportunity for smart companies to grab a meaningful piece of the total market. A recent report on travel companies from Conductor, a content marketing platform acquired by WeWork, gives a sense of just how much white space is still available for intrepid companies to capture.

“Travel & Hospitality 2018: Digital Marketing Leaders” looked at more than 12 million travel-related searches by U.S-based consumers. The researchers broke these searches down into 45,000 search terms (such as “best hotels in NYC” or “top attractions in Miami”), weighting each of them by popularity. They then tracked the companies that managed to reach the number one position in Google searches.

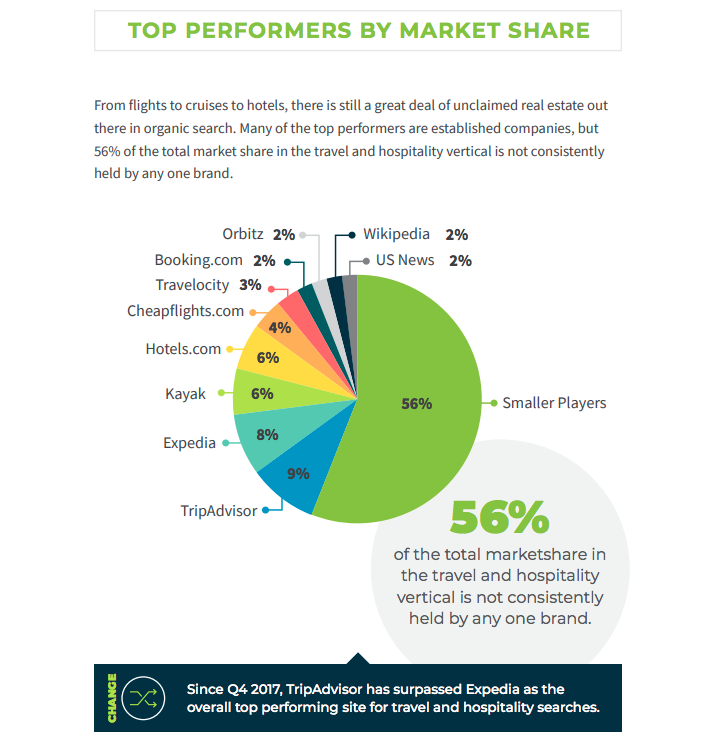

Looking at these top performers, what’s most striking is that only 10 sites captured more than 2 percent of the top searches. These included some of the biggest names in the business, including TripAdvisor (9 percent), Expedia (8 percent), Kayak (6 percent), and Hotels.com (6 percent; owned by Expedia). But a majority of the top searches—56 percent—were from smaller companies, a sign of a very diffuse market.

Slicing and dicing the data shows that no company has what could be called a commanding lead. In the results that came up in searches related to local attractions, for instance, TripAdvisor was on top, with a full 10 percent of the number one results. But once again, the majority of number one results were from companies that aren’t necessarily household names.

For those hoping to break into the shortlist of “top-10 attractions” performers, it’s worth noting one thing they all had in common: lots of bite-sized content. Superlatives and rankings were the name of the game. There are at least two major reasons for this. The first is technical: Providing search engines information in a way that’s easy to parse is likely to help with results, simply because it’s easier for Google and others to scrape and display it on results pages.

But “listification” also has a user-experience advantage. Charity Stebbins, content director at Conductor, compared such short-and-sweet information to “window shopping.” It’s a way of replicating the “brick-and-mortar experience” by being able to consider many different options at the same time, without getting too deep too early in the process.

Making sure your content is scannable and easy to skim is just part of the battle, though. Very few companies will be able to win at all sorts of searches, but most can improve their placement if they specialize, prioritizing the things that are most important to their most promising likely customers.

Christine Schrader, content marketer manager at Conductor, stressed that to succeed, companies “really have to build a localized strategy.” For instance, putting the effort into an in-depth guide to Chicago or even some of its neighborhoods is probably a better use of time for a local hotel than a more general article about cool cities in the Midwest. “Those are the players that are winning,” says Schrader.

The report mentions as a “small player standout” the Pod hotels minichain, which has four locations in New York and one in Washington, D.C. It has managed to climb to number one for “some massive searches,” says Schrader, including “hotels DC” (368,000 searches a month) and “best hotels NYC” (22,000 a month).

How do companies like Pod accomplish this? John Newton, founder of Signal Custom Content, which creates travel-focused content for Afar and other travel companies, said companies need to be clear-eyed idea of their audience and the channels and content most likely to get through to it.

“It surprises me whenever I hear about luxury travel brands trying to figure out what to do with, say, Snapchat,” he says. “I really don’t think that’s where the people who actually book rooms at luxury hotels are going to be found.” Without thinking carefully about audience, the “content won’t be convincing and the investment may end up have a negative impact. The brand risks undermining their credibility with subpar content.”