When it comes to property success, the ability to stay agile is key. Why lock your business into inflexible long-term leases that drive up liability, deal with inefficient space utilisation or grapple with unpredictable year-on-year expenses that derail budget planning?

WeWork’s agile workspace solutions can solve these challenges and more. That’s why today’s enterprise-level companies, including one-third of the Fortune 500, partner with WeWork. Read on to discover why.

1. Reduce capital expenditure

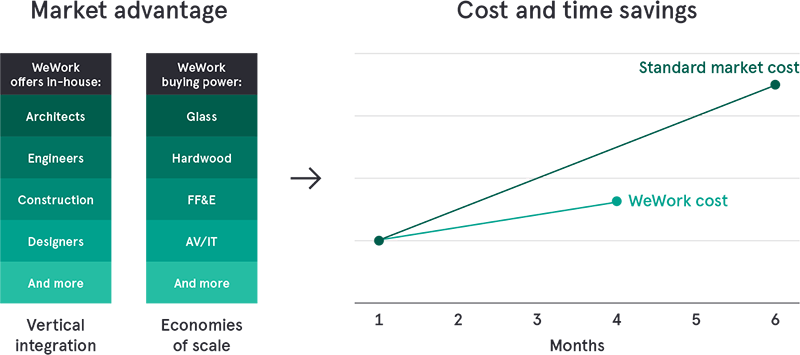

WeWork’s position in the market unlocks unique business opportunities. Firstly, by combining in-house vertical integration with scaled buying power, we pass on our savings to our members.

Secondly, we avoid burdening our members with all-in capital expenditures. We achieve this by amortising WeWork’s standard fit-out contribution over our long-term leases, and charging members only for the time that they occupy the space. All of this allows members to access beautifully designed, turnkey space with reduced capital exposure.

2. Stabilise expenses

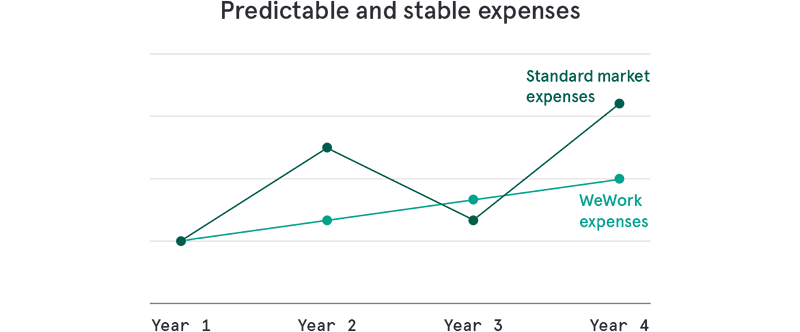

We offer a fixed rate with annualised escalations on property costs, operational expenses, amortised capital improvements and management fees – providing predictability and stability for every property budget.

For many clients, this is a welcome change from the volatility caused by variable expenses.

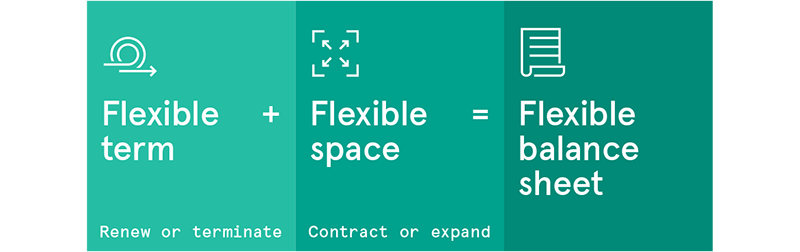

3. Optimise committed liability

We provide shorter-term memberships, compared to market-standard leases – resulting in reduced balance-sheet liabilities. In other words, you choose what’s right for your business, with commitments ranging from one month to 15 years.

4. Align with GAAP/IFRS

WeWork addresses changes to the generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS) by offering products that can reduce balance sheet impact.

Short-term flexibility

Leases/licences of fewer than 12 months do not need to be recorded on the balance sheet.

Termination options

Long-term leases/licences with termination options – if reasonably certain to exercise – can be recorded as short-term obligations, thus reducing the long-term liability to the income and balance sheet.

Lease vs non-lease components

Instead of carrying non-lease items in the straight-line rent and balance sheet, WeWork can break out lease vs non-lease items from the overall membership fee (when applicable).

WeWork access

WeWork access passes can be considered service contracts instead of leases or licences, which means they do not need to be recorded on the balance sheet; they can be recorded as standard operating expenses to the income statement.

5. Increase property adaptability

At WeWork, businesses consume property more efficiently by only paying for the space that they need. That means cutting wasted space and, therefore, wasted spend.

Now, businesses have the ability to adapt their property footprint – no matter how often employee head count might fluctuate.

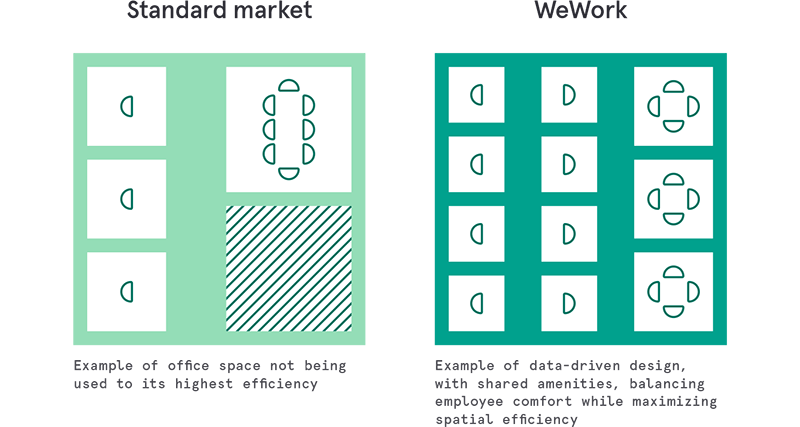

6. Achieve greater spatial efficiency

WeWork enables businesses to use space more efficiently – by requiring less of it – in two primary ways. Firstly, WeWork typically operates at higher densities than traditional workplaces, using data to determine the best possible design to balance employee comfort and collaboration.

Secondly, our members have access to a diverse range of shared amenities, such as kitchens, lounges, large meeting rooms and training areas. Accessing these resources on-demand enables businesses to reduce their direct space requirements.

WeWork offers companies of all sizes space solutions that help solve their biggest business challenges.

Copyright © 2019 WeWork Companies Inc. All rights reserved. WeWork and its affiliates do not provide tax, legal or accounting advice. These materials have been prepared for informational purposes only, and are not intended to provide, and should not be relied on for tax, legal or accounting advice. Counterparties should consult with their tax, legal and accounting advisors and/or auditors in connection with these materials and any related determinations.